INTRODUCTION

Well developed securities market are the backbone of any financial

system . It serves as a barometer of the financial health of the

economy.

IFS is the medium that aids in channelizing & Mobilization of funds for

investment related purposes . they also help in determine the prices of

securities . With passage of time , The Indian security market has undergone

remarkable changes & grown exponentially , particularly in terms of

·

RESOURCE ALLOCATION

·

INTERMEDIARIES

·

THE NUMBER OF LISTED STOCK

·

MARKET CAPITALISATION

·

TURNOVER & INVESTOR

POPULATION

·

INVESTOR PROTECTION

RECENT TRENDS & DEVELOPMENTS IN INDIAN SECURITIES MARKET

SEBI ACT ,1992 : SEBI has replaced the Capital Issues (Control)Act , 1947 . It is autonomous body of CG having perpetual succession & common seal .

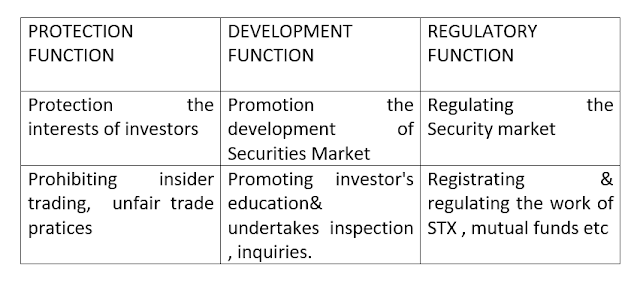

OBJECTIVES / FUNCTIONS OF SEBI :

SCREEN BASED TRADING

A nationwide online fully automated screen based trading system (SBTS) was originated

where a member can punch quantities of securities & the prices into

computer at which he likes to transact & the transaction is excuted as soon

as it finds a matching a sale & buy order from other party.

REDUCTION OF TRADE CYCLE / ROLLING SETTLEMENT

Earlier , the trading cycle for stocks which varied from 14days to 30 days

& the settlement involved another fortnight.

IN DEC 2001 All scrips & dealing of securities were moved to rolling

settlement & settlement period was reduced progressively from T+5 days to

T+3 days.

From April, 2003 onwards , T+2 days settlement cycle is being allowed .

DEPOSITORIES ACT , 1996

Depositories ( NSDL , CDSL ) is an agency with whom securities are

deposited in electronic form .

It was introduced for the fast , inexpensive & hassle free transactions

of securities .

DEMATERIALISATION

The Process by which physical certificates of an investor are converted

into equal number of securities in electronic form & credited into investor

's account with depository participant .

PROCESS OF DEMATERIALISATION

GLOBALIZATION

Indian companies were permitted to tap foreign markets by issusing ADR, GDR

& FCCB . RBI has permitted two way fungibility for ADR / GDR which means

the investor who hold ADR/ GDR 'S can cancel them with depository & sell

the underlying shares in the market.

RESEARCH IN SECURITIES MARKET

In collaboration with NCAER ( National council of applied economic research

) , SEBI brought out a survey of india investors which estimates investor

protection in India .

DIRECT MARKET ACCESS

It is a facility which allows brokers to offer clients direct approach to

the exchange trading system through the broker 's infrastructure without manual

intervention by the broker.

CONCLUSION

SEBI has come a long way since its Inception as an institutions regulating

the Indian Securities Market. It has boosted a lot of reforms to increase the

safety of investors in the stock market .

YOU TUBE LINK:

Author Name:

Himanshi Chugh

(Assistant Professor, Management Department)

4 Comments

Amazing

ReplyDeleteBest 👍

ReplyDeleteVery nice

ReplyDeleteknowledgeable

ReplyDelete